Page 7 - Al-Rashed Newsletter March 19

P. 7

POTPOURRI

OUT OF THE BOX

Lets take a short breather from the shipping and logistics and focus on personal

finances.

Some people manage their money like they were born with calculators in their

hands. Others…not so much. Maybe they fall prey to their own instincts to spend

more than they should. Maybe math just isn’t their strong suit or they find it

unbearably tedious to keep track of pennies and dimes.The most recent survey

indicated that a walloping 70 percent of us believe we’re on shaky financial ground.

Even more — 75 percent — are of the firm belief that we’d be a whole lot happier if

we just had more money.So what can you do to get a grip on your finances and

make your money grow? Learn. Educate yourself. That’s how Elon Musk and

Warren Buffett started out.

“Do you know Bill Gates and Mukesh Ambani are the richest in the world because

they own equities”

Had you been holding on to a few stocks, where companies had competitive edge

and earnings growth on their side, you would have ended up gaining up to Rs 3

crore on just Rs 10,000 investment.

Infosys is one such stock. An investment of Rs 10,000 in this counter in June 1993

would have delivered you 2,973 times return! That Rs 10,000 investment would now

have been worth Rs 2.97 crore at a compounded annual growth rate (CAGR) of 39

per cent.

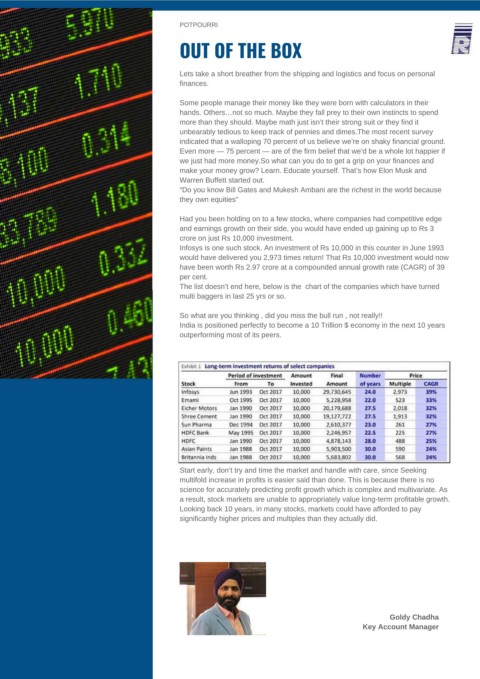

The list doesn’t end here, below is the chart of the companies which have turned

multi baggers in last 25 yrs or so.

So what are you thinking , did you miss the bull run , not really!!

India is positioned perfectly to become a 10 Trillion $ economy in the next 10 years

outperforming most of its peers.

THERE IS NO SCIENCE

FOR ACCURATELY

PREDICTING PROFIT

GROWTH WHICH IS

COMPLEX AND Start early, don’t try and time the market and handle with care, since Seeking

MULTIVARIATE. multifold increase in profits is easier said than done. This is because there is no

science for accurately predicting profit growth which is complex and multivariate. As

a result, stock markets are unable to appropriately value long-term profitable growth.

Looking back 10 years, in many stocks, markets could have afforded to pay

significantly higher prices and multiples than they actually did.

Goldy Chadha

Key Account Manager